As the global landscape of semiconductor manufacturing evolves, the conversation has increasingly focused on the sustainability and economic impact of producing chips in the United States. For industry giants like TSMC, establishing manufacturing operations in America poses a significant challenge to profit margins. This shift in production strategy is driven by broader geopolitical considerations, despite the associated financial hurdles.

Rising Costs and Strategic Shifts

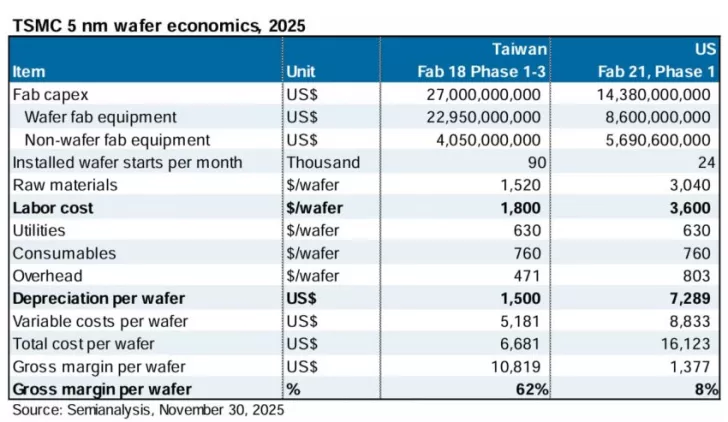

Under the Trump administration, there was a strong push towards a “Made in USA” approach, particularly in the semiconductor sector. This led companies like TSMC and Samsung to invest heavily in developing an American supply chain. TSMC, in particular, has committed up to $300 billion to its US operations, including a fab network in Arizona and advanced R&D facilities. However, these efforts come at a cost. According to industry analysts, producing chips in the US significantly impacts TSMC’s gross margins due to increased labor and depreciation costs per wafer.

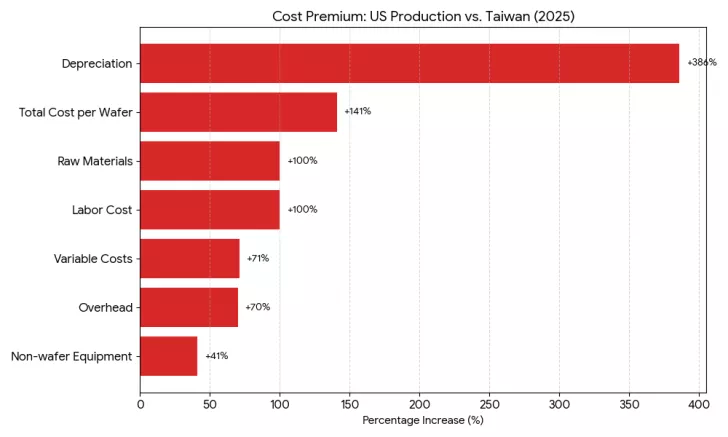

Operating fabs in the US is proving to be an expensive venture for TSMC, with labor costs and depreciation as the primary factors driving up expenses. The depreciation aspect is particularly challenging, as it reflects the total fab production and the lifespan of its equipment. For instance, a US facility producing fewer wafers compared to a Taiwanese fab inevitably results in higher per-wafer costs.

Labor Challenges and Cultural Differences

One of the most significant issues facing TSMC’s US operations is labor costs. The company must decide between hiring American workers or bringing in employees from Taiwan. The latter option often proves more cost-effective, as it aligns better with the company’s established work culture and response times during operational emergencies.

If it breaks down at 1 in the morning, in the U.S. it will be fixed the next morning, but in Taiwan, it will be fixed at 2 a.m. If an engineer gets a call when he is asleep, he will wake up and start dressing… This is the work culture.

– TSMC’s Morris Chang

The Bigger Picture and Future Prospects

While TSMC faces immediate financial challenges in its US expansion, the long-term strategic importance of a diversified supply chain cannot be overstated. The recent report of a significant quarterly profit decline for TSMC’s Arizona fab underscores the high operating costs that challenge the viability of US manufacturing. However, these efforts are crucial to minimizing the impact of geopolitical tensions on TSMC’s clients, with companies like NVIDIA supporting TSMC’s pivot to America. The move towards building a robust American supply chain is a monumental task that may take decades, but it remains essential for TSMC as the world’s leading chip producer to maintain a global foothold.