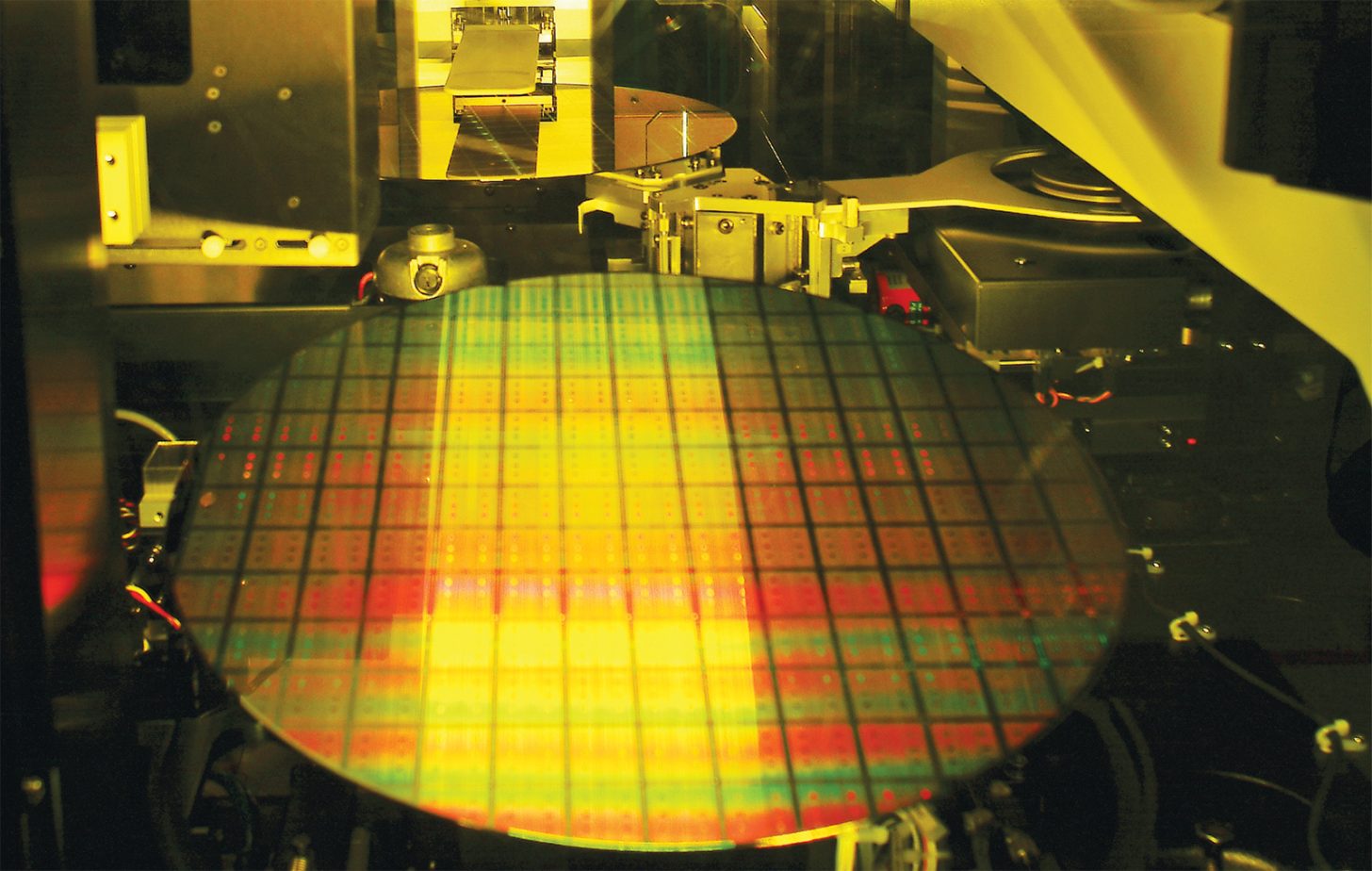

In the dynamic world of semiconductors, supply chain disruptions are causing ripple effects for major players, turning the industry’s attention to alternatives. TSMC, a titan in chip manufacturing, faces unprecedented demand that is stretching its production limits. This bottleneck is prompting companies to explore other avenues, with Samsung Foundry emerging as a prominent contender for their chip sourcing needs.

Shift in Demand Among Tech Giants

As TSMC grapples with capacity constraints and rising costs for its cutting-edge 2nm process, global tech leaders are eyeing Samsung Electronics to diversify their supply chains. The influx of orders at TSMC has created a strategic opening for Samsung, the second-largest supplier in the field. Reports suggest that the saturation of TSMC’s production capabilities is driving this shift.

As TSMC raises prices for its 2nm process and orders surge, global big tech companies are turning their attention to Samsung Electronics to diversify their supply chains. The saturation of the leading supplier’s production capacity presents a clear opportunity for the second-largest supplier.

Manufacturers are increasingly concerned about TSMC’s ability to meet demand in a timely manner. Although TSMC is known for accommodating supply requests, the current climate prioritizes speed to market. Thus, Samsung Foundry becomes an attractive option for those unwilling to risk delays with an overextended foundry.

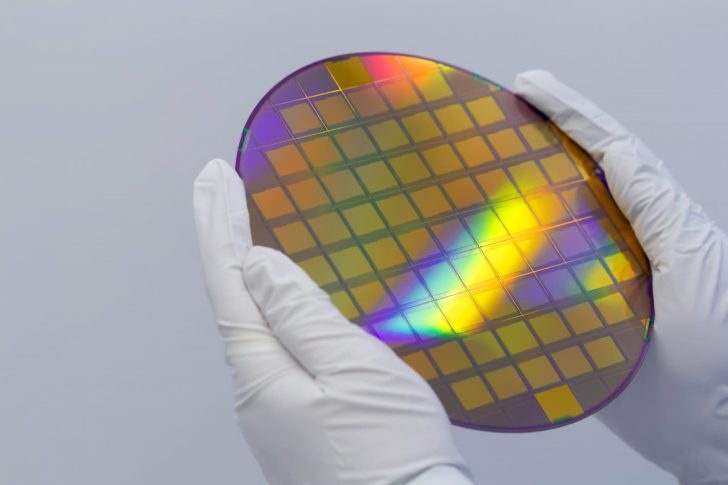

Samsung and Intel Poised for Growth

Meta, seeking to produce its MTIA ASICs, is reportedly considering orders with Samsung Foundry, potentially utilizing the SF2 process. This move is indicative of Samsung’s growing allure, as Qualcomm and AMD are also rumored to be exploring opportunities with the foundry. The primary driving force is not just Samsung’s technological advancements, but also the overflow of TSMC’s order book, which Samsung aims to capitalize on.

Similarly, Intel Foundry is attracting interest for its 18A and 14A processes, thanks to its reputation as a leading American manufacturer. This appeal is particularly strong for US-based fabless companies. Industry trends point to a crucial need for diversification in chip supply lines, suggesting that Samsung and Intel could enjoy a surge in external adoption of their chip manufacturing capabilities in the near future.