The memory market is poised for a challenging period as one of the leading memory producers anticipates DRAM supply constraints persisting through 2028. This prolonged imbalance could significantly impact the affordability and availability of PCs for the average consumer.

SK Hynix’s Forecast on Commodity DRAM Supply

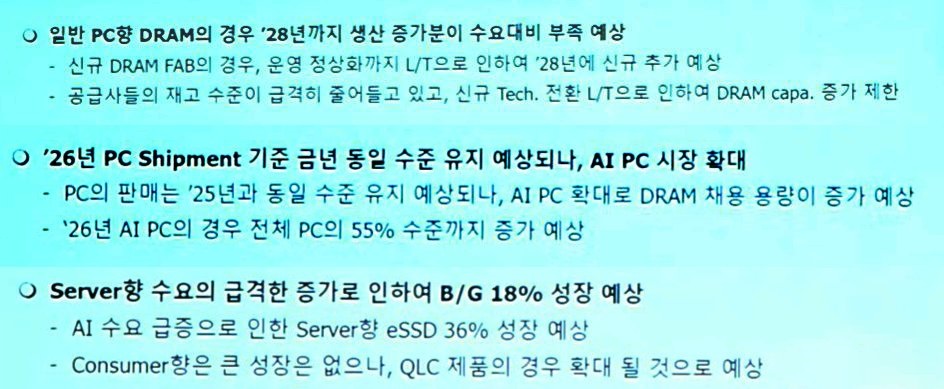

The mainstream PC sector is on alert as reports suggest a persistent memory supply-demand disparity that might continue until the end of 2028. An internal analysis from SK Hynix indicates minimal growth in “commodity” DRAM, struggling to keep pace with surging demand. This scenario has driven up DRAM prices and made it increasingly difficult for consumers to access affordable PCs.

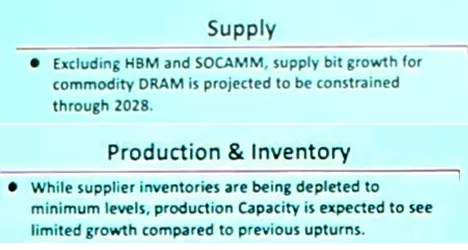

The user @BullsLab shared insights from SK Hynix’s analysis. It highlights that apart from high-bandwidth memory (HBM) and SOCAMM modules, growth in commodity DRAM is expected to remain restrained until at least 2028. Memory producers have shifted their priorities to meet the burgeoning demands of AI servers, leaving little room for consumer market expansion.

Challenges in DRAM Supply and Demand

Current supplier inventories have reportedly fallen to unprecedented lows, worsening allocation pressure. Sources indicate that SK Hynix and other memory manufacturers are adopting conservative capacity expansion strategies, prioritizing profitability over increasing DRAM supply. Server DRAM demand is surging, and this trend is expected to accelerate next year.

It’s anticipated that the server share will grow from 38% in 2025 to an impressive 53% by 2030. The AI boom is prompting a surge in AI training data center constructions among cloud providers, leading to a DRAM super-cycle. Some sources suggest that manufacturers have already secured key DRAM production slots for 2026, while traditional PC DRAM production is expected to fall short of demand for the foreseeable future.

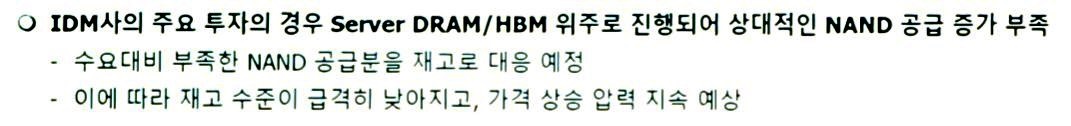

There’s already been a noticeable increase in AI PC market share, with AI PC systems projected to represent about 55% of the total PC market by 2026, despite stable overall PC shipments in 2025. For NAND memory, SK Hynix’s analysis indicates that consumer market supply may lag due to stronger demand from servers, driven by higher profitability.

Overall, this analysis paints a concerning picture for consumers. What was initially thought to be a temporary situation extending until 2027 may now persist well into 2028.