Intel’s strategic advancements in their foundry operations are drawing significant attention, as the company focuses on upcoming processes and their advanced packaging portfolio. This optimism is buoyed by developments in Intel’s 18A process and packaging technologies, which are set to redefine the industry standards.

Intel’s VP Dismisses Spin-off Concerns Amidst Chip Advancements

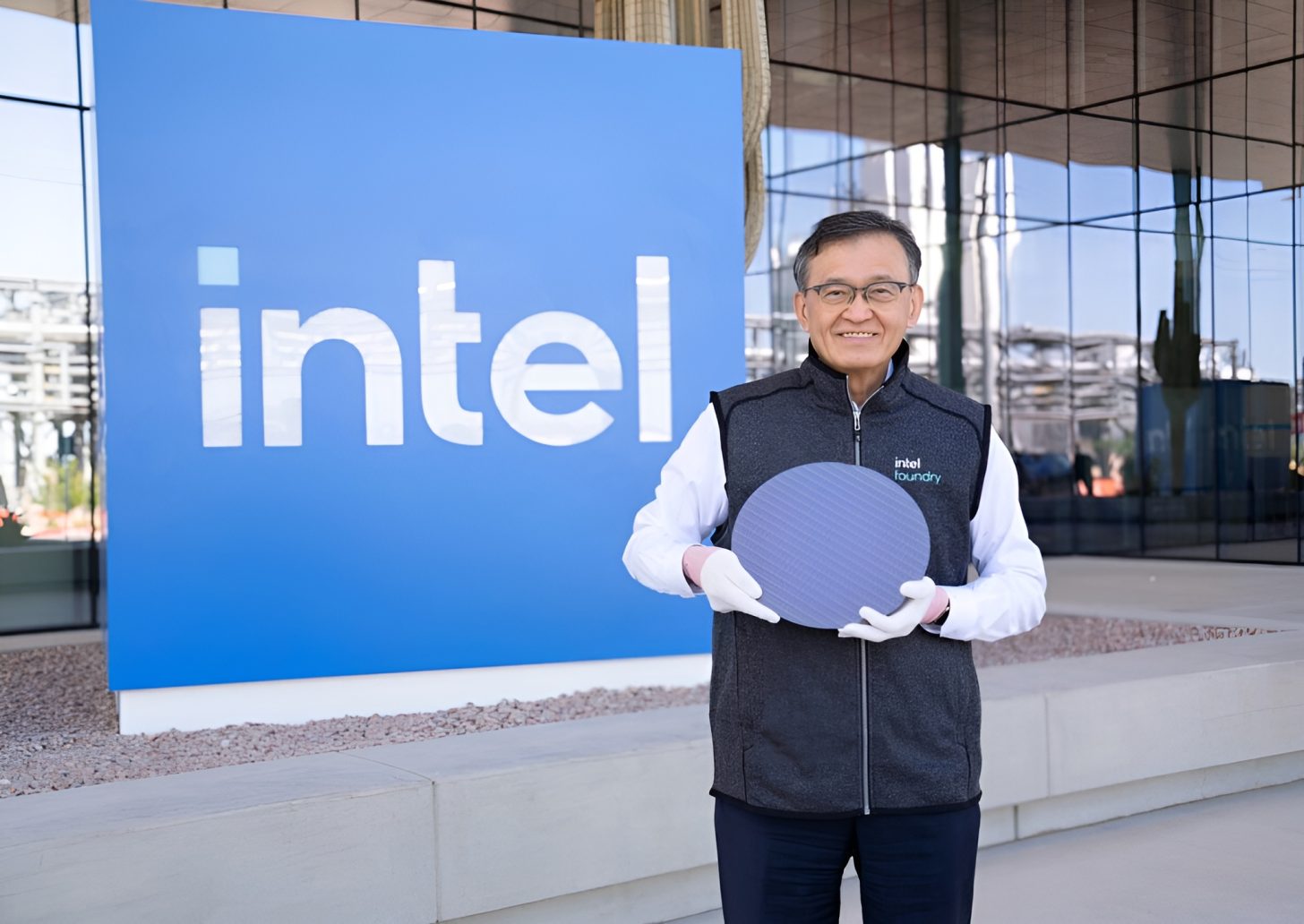

At the UBS Global Technology and AI Conference, Intel’s Vice President of Corporate Planning, John Pitzer, highlighted the company’s progress with the 18A process, underscoring its importance for the foundry division’s margins. Intel is gearing up to showcase their Panther Lake chips by January 5, marking a significant milestone. Despite yield rates not reaching optimal levels yet, improvements have been consistent since CEO Lip-Bu Tan’s appointment in March, aligning with industry expectations.

And I see — I think we’re starting to see the benefits of that because at the very least, yields are still not at the levels we want them to be and they will continue to get better over time, as Dave talked about on the earnings call. But we are now in a position where we’re seeing predictable improvement month-on-month, that’s in line with what you would expect as an industry average.

Interest in Advanced Nodes and External Adoption

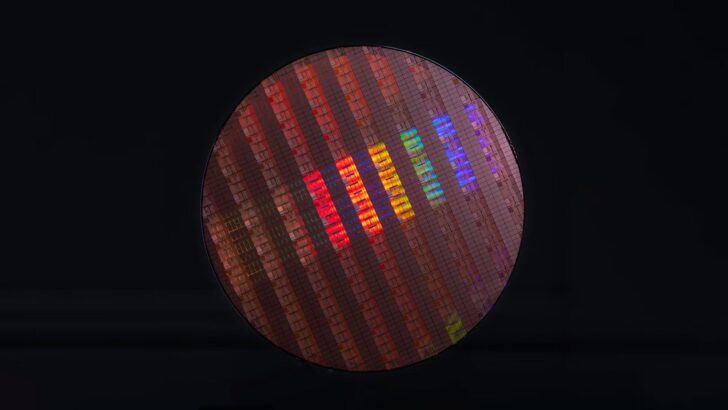

Addressing the growing interest in the 18A-P node, Intel’s executive mentioned the process’s maturity and plans to engage with external customers. Both the 18A-P and 18A-PT nodes are poised for internal and external use, drawing consumer interest due to progress with PDKs, although Intel prefers to let clients reveal potential node adoptions.

Packaging Innovations Capture Industry Attention

Intel’s advanced packaging solutions are becoming a noteworthy prospect, especially in light of CoWoS output bottlenecks. Their success with EMIB, EMIB-T, and Foveros packaging is evident, as these solutions present viable alternatives to current market offerings. The “spillover effect” has led to strategic conversations with new customers.

Yes. I mean we’re pretty excited about the technology. I mean if you go back and think about the journey we’ve been on in advanced packaging, we were pretty excited about the business about 12, 18 months ago, in large part because we saw a lot of customers coming to us to be spillover capacity because CoWoS was so tight. And for full transparency, we probably under hit the potential for that business.

I think TSMC did a very good job increasing CoWoS capacity. We probably underperformed a little bit and getting Foveros where it needed to be. But the advantage of having that happen is it brought customers in the door and it allowed us to start moving from tactical conversations to strategic conversations.

The current sentiment within Intel Foundry is one of optimism, particularly as external customers express interest in both chip and packaging solutions. This optimism supports Intel’s decision not to pursue a foundry spinoff, as the division is expected to bolster its current position.